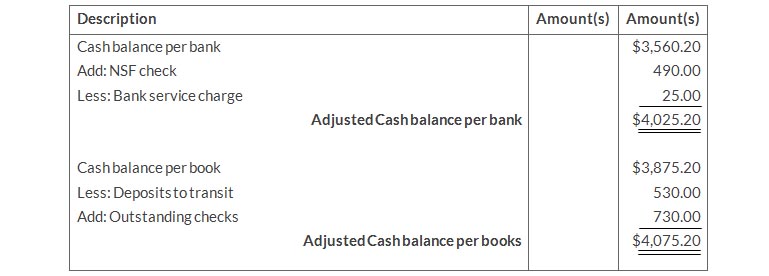

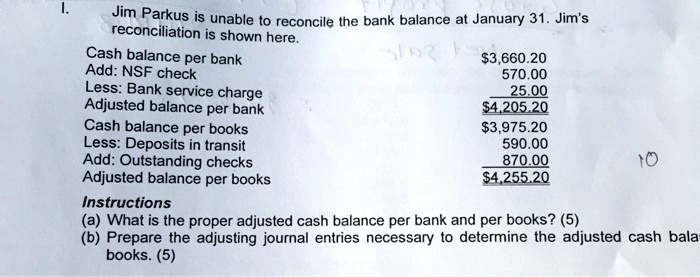

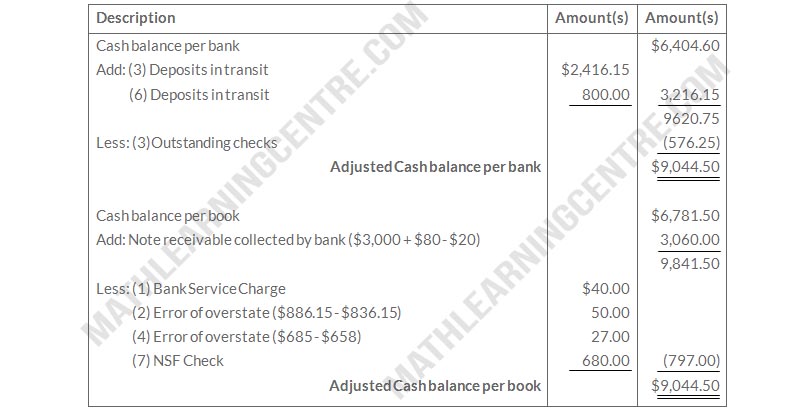

SOLVED: Reconciliation is shown here. Cash balance per bank: 3,660.20. Add: NSF check:570.00. Less: Bank service charge: 25.00. Adjusted balance per bank:4,205.20. Cash balance per books: 3,975.20. Less: Deposits in transit:590.00. Add:

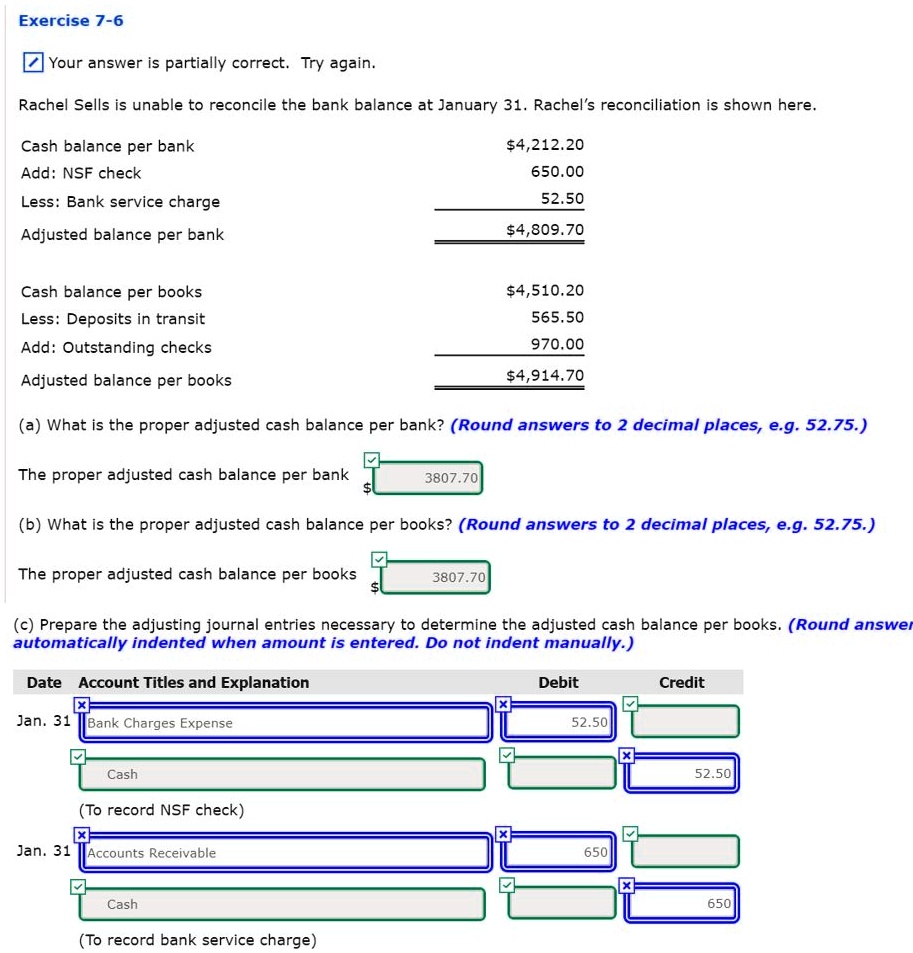

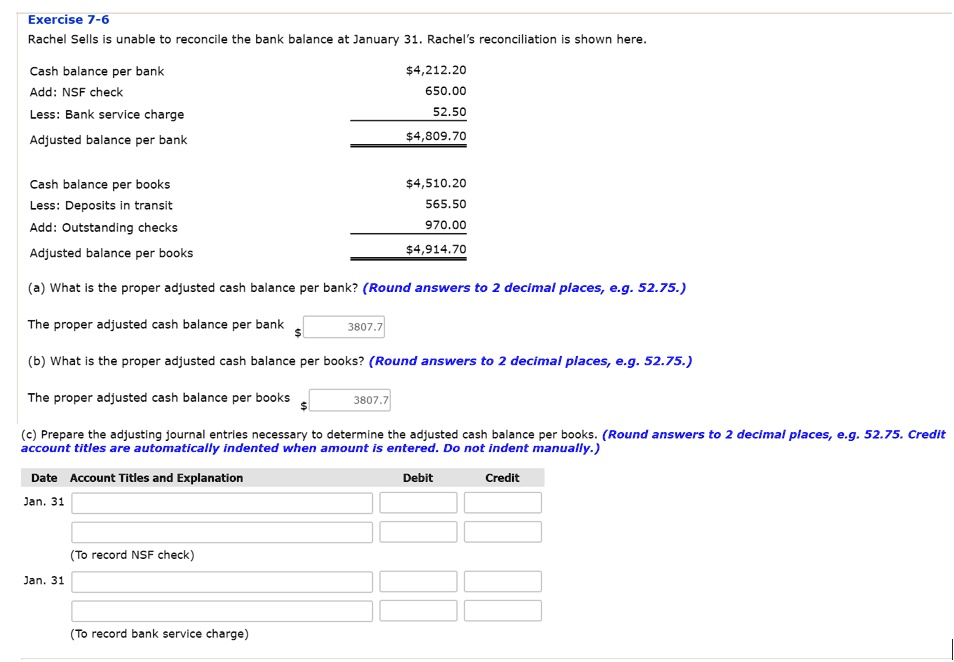

SOLVED: Exercise 7-6 Your answer is partially correct. Try again. Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown here: Cash balance per bank: 4,212.20

Chapter – 8: Fraud, Internal Control & Cash OverviewControl FeaturesBank ReconciliationAdjusting Entries. - ppt download

The following information pertains to Crane Video Company. 1.Cash balance per bank, July 31, $8,183. 2.July bank service charge not recorded by the depositor $35. 3.Cash balance per books, July 31, | Homework.Study.com

SOLVED: Exercise 7-6 Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown here: Cash balance per bank 4,212.20 Add: NSF check650.00 Less: Bank service charge

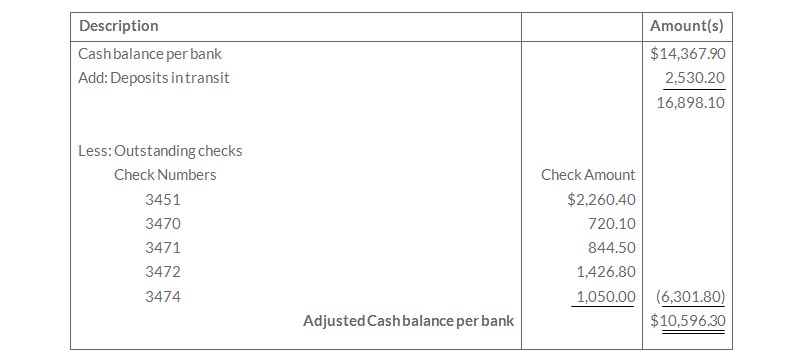

![SOLUTION TO EXERCISE 7-7 - Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition [Book] SOLUTION TO EXERCISE 7-7 - Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition [Book]](https://www.oreilly.com/api/v2/epubs/9781118102923/files/images/p225-001.jpg)

SOLUTION TO EXERCISE 7-7 - Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition [Book]

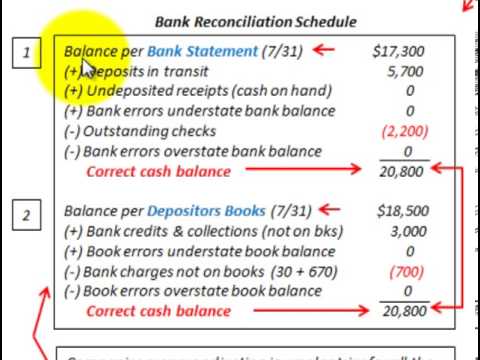

What adjustments are made to a bank balance when preparing a balance reconciliation? - Universal CPA Review

:max_bytes(150000):strip_icc()/book-balance-4200440-4x3-01-final-1-2f0abc7003fc453e88f94342fbc3b2d8.png)

![Solved] Rachel Sells is unable to reconcile the b | SolutionInn Solved] Rachel Sells is unable to reconcile the b | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/09/613d7b210427e_1631419168520.jpg)